New Zealand’s future is electric. More electricity generation is needed to meet increasing demand and to replace fossil fuel-fired generation. Increasing electricity production will also enable the decarbonisation of the economy – which is needed to meet New Zealand’s climate goals.

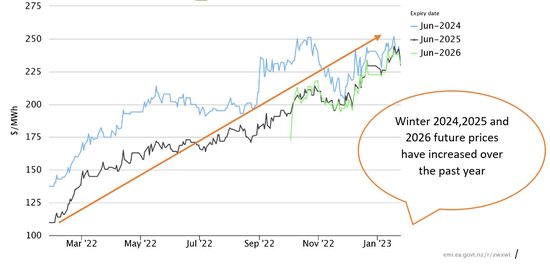

Despite the building of more renewable generation plants, future prices 1 for winter 2024, 2025 and 2026 remain high (see figure 1). However, more renewable generation should act to depress spot prices in the long run, as it is generally cheaper to produce. So why are near-term winter future prices high?

There is ~2,600 GWh/year of new renewable electricity generation 2 expected to be online between now and 2026. This will be mostly solar farms, followed by wind turbines and geothermal. Doubt, however, around commissioning times is increasing. Many build projects are facing covid-induced supply chain issues, long consenting times and increasing costs. Hence, there is growing uncertainty about what generation will be online for each winter.

During winter peak demand, New Zealand consumes the highest volumes of electricity. In recent years, situations have occurred where available electricity supply has been quite tight 3 . Electricity spot prices during these times are generally high, as expensive fossil-fuelled generation is needed to meet high demand.

Most new renewable generation is intermittent. Wind and solar farms cannot be relied on to cover winter peaks, as it could be dark, windless or cloudy. Therefore, until large-scale energy storage is available (which stores excess energy from intermittent generation), or demand flexibility becomes more prevalent, fossil-fuelled generation will remain available to meet winter demand. Furthermore, many fossil-fuelled power stations are approaching retirement and requiring more maintenance, which adds extra costs. Last year, Contact Energy announced that it will retire TCC 4 in 2024. This might see Huntly’s more expensive Rankine units running more often, especially over winter.

Compounding this, future gas supply also remains uncertain and coal prices kept increasing over 2022. Coal prices are forecast to stay high, and carbon prices will also increase. These uncertainties, alongside expectations of increasing costs of running fossil-fuelled plants, have likely contributed to the increase in futures prices over 2022.

Committed new renewable generation is enough to meet projected demand growth. However, it is unlikely sufficient to displace all fossil-fuelled generation. This shortfall in renewable investment is likely to keep fossil-fuelled generation in the market, to avoid electricity shortages. Hence spot prices will remain high, as indicated by the predicted winter 2023, 2024 and 2025 futures prices.

Transpower monitors new connection enquiries to the electricity grid. Using its dashboard, you can see what regions have high volumes of enquiries, and filter between different types of network connections, including generation, energy storage and network upgrades.

In our Review of the wholesale market competition, we proposed to increase our monitoring of new generation to better ensure the efficient, reliable, and competitive operation of Aotearoa's electricity market. Thanks to all those who made a submission. We are currently assessing our proposal in light of your submissions and will then publish our decision on this website.